Non-Business or June 30 th July 15 th Individual. For an employee covered under the Employment Act the minimum leave pay should be calculated using 26 workdays to arrive at the ordinary rate of pay wages 26.

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

Highlight the real costs that you have incurred as a result.

. Under section 14 1 Employment Act 1955. Salary deduction refers to the amount withheld by an employer from an employees earnings. If they resigned without notice their pay must be in within seven days of their last day.

Such breach shows that the employer no longer wants to be bound by one of the essential terms of the. Was awarded RM43200 in back wages by the Industrial Court for constructive dismissal as the employer had failed to pay his salary. Subject to subsection 2 every employer shall pay to each of his employees not later than the seventh day after the last day of any wage period the wages less lawful deductions earned by such employee during such wage period.

In North Malaysia Distributors Sdn Bhd v Ang Cheng Poh 2001 the employers cut the employees pay on the premise that the economy wasnt doing great. Compensation for breach of a contract of service. Stress the distress and that the certainty of payment is vital.

Setting salaries for your staff is always a tricky thing to do. Appeal Against Tax Increase For Delay In Income Tax Payment. JTKSMs labour standards division director Mohd Asri Abd Wahab said the department had received.

By all means ask for recompense and be prepared to negotiate. Late Salary Payment and other advise needed Late Salary Payment and other advise needed. Issue a show cause letter.

Employees regular pay late with a 100 penalty. Section 19 1 of the Employment Act 1955 says. QUOTE Beth79 Mar 24 2011 0919 PM Heres the short answer- if u are an employee under the employment act-the company cannot deduct salary for coming in late and must pay you overtime.

Employers in Malaysia are reminded that any salary deductions or cuts cannot be done without the employees knowledge or without approval of the Labour Department of Peninsular Malaysia JTKSM as reported in Bernama. Home Late Salary Payment Malaysia What If An Employer Really Can T Pay During The Mco Period Late Night Laws. This scenario actually takes place more often than we know and one such case happened in 2001.

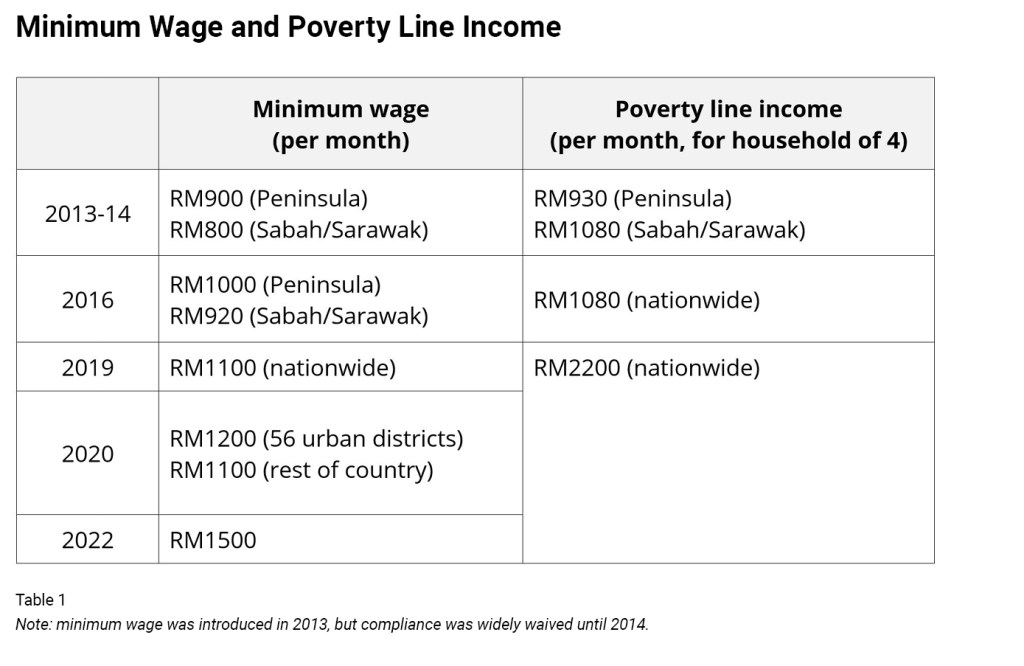

Do late payments always lead to legal trouble. However any amount more favourable to the employee than the minimum leave pay is also acceptable. Raising minimum salaries and lowering executive pay always sounds great on paper.

The law cannot help much in such FINANCIAL situation. If the GM is at all reasonable he will listen and attempt to do something may not meet all costs but should meet some. Legal charges like fines and warnings.

Wait for reply from employee. A late payment of 10 will be imposed on the balance of tax not paid after April 30 th May 15 th Individual. Many industries have been impacted severely by the Covid-19 pandemic that led to retrenchment of their employees in Malaysia.

Employees who earn monthly wages of RM2000 or less. According to the Employment Acts Section 24 1 no deductions shall be made by an employer from the wages of an employee unless stated. 1 Usual scenario where the employee returns to work ensure that all requirements as stated in the key words are satisfied.

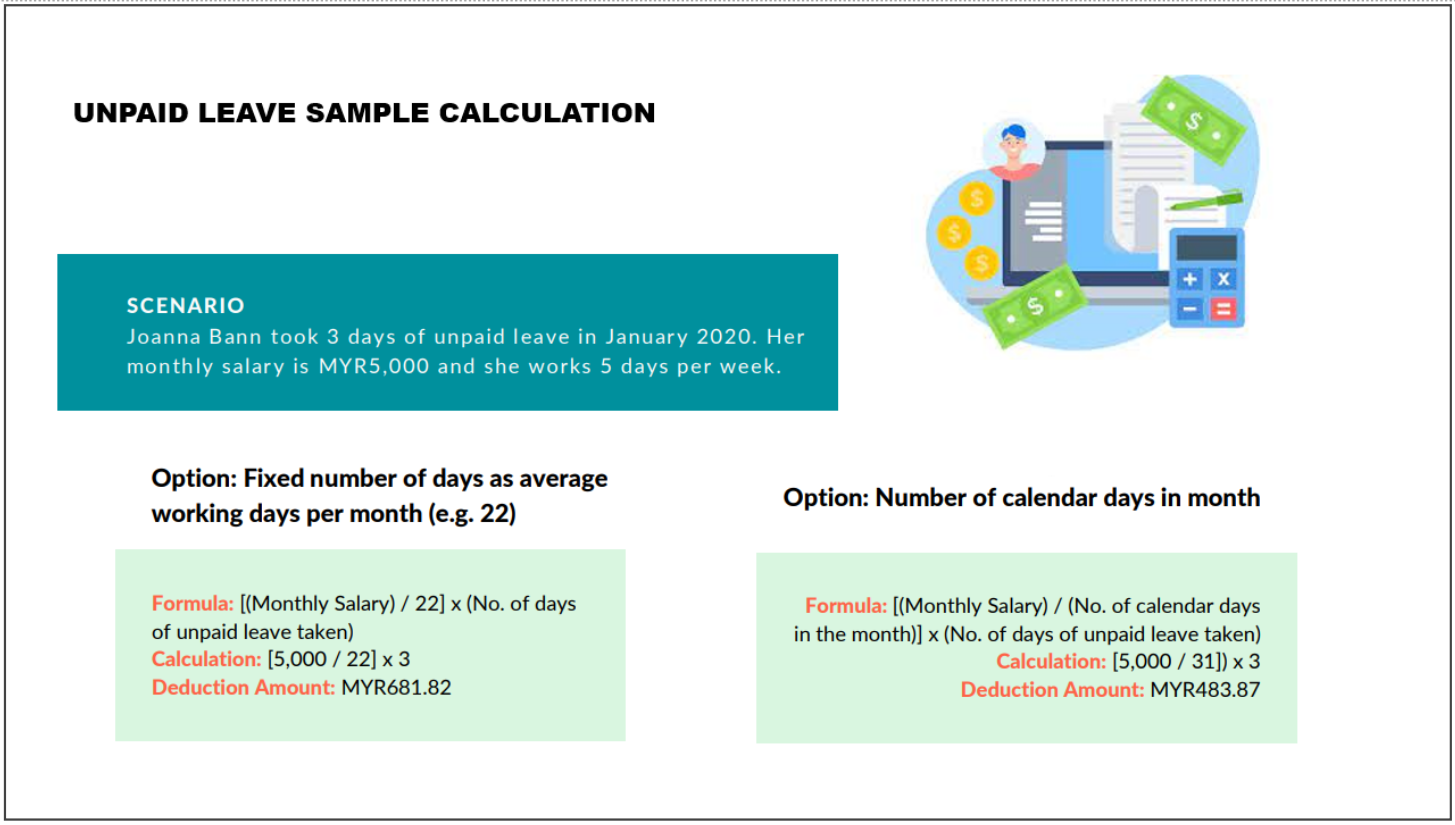

So for an employee who works 5 days a week it is usual to use 22 workdays instead. Sections 24 2 to 6 state when and how employers can make lawful deductions of employees wages. If I still have not received my salary on the 15th of June is the Employer considered late to pay my salary.

Can My Employer Deduct My Pay For Coming Late To Work Malaysia. If you are not under the employment act it depends on your contract etc. Malaysia Forum Malaysia News Malaysia Covid 19 Malaysia Visa Immigration Malaysia Golf Malaysia General Chat Myanmar.

Salary or wages in lieu of notice. We always hope that we do not charge you extra. A payment into an account at a bank or a finance company licensed under the Banking and Financial Institutions Act 1989 in any part of Malaysia being an account in the name of the employee or an account in the name of the employee jointly with one or more other persons.

Taxpayer can appeal upon the tax increment imposed by submitting a written appeal to Collection Unit of IRBM branch thats handling his tax file. How Much Interest Can I Charge On Overdue Invoices In Malaysia. Three months ago gravity payments raised its minimum salary to 70000.

So to cut their losses a company may deduct the employees salaries instead. Employers are required to pay employees their full salary on time no. Read the reply from the employee and determine if the excuse is acceptable.

Free Malaysia Today FMT 266 C. You will be charged for the Late Payment Penalty for every 7 seven days of non-payment. Meaning that your salary for May 2021 should be paid by 7 th June 2021.

Salary must be paid within 7 days of expiry of wage period you are considered lucky and able to receive your wage late for 10 days. If the employee resigned or gets fired and served notice their final salary must be paid on the last day of employment. Go to the labour department and make a complaint.

Many employees in Many other companies in the Whole of Malaysia and Other Countries also Wait to get their salaries late for weeks and Even Months. However the Act only covers a number of select employee categories in Malaysia. Payments to obtain release from a contingent liability employers obligation under a contract of service.

However if you are late for repayment we will then need to charge you as per the table below. Paying employee wages late According to the Employment Act 1955 employers are required to payout monthly wages on the seventh day of the following month or earlier. In North Malaysia Distributors Sdn Bhd v Ang Cheng Poh 2001 3 ILR 387 the court held that the employers unilateral reduction of an employees salary constituted a significant breach of going to the root of the contract of employment.

B payment by cheque made payable to or to the order of the employee. Section 19 of the Employment Act 1955 provides that the Employer shall pay each of his employees within 7 days after the last day of any salary payment period. You are supposed to be paid within 7 days.

By W2Wang September 4 2017 in Jobs economy banking business investments. Interest is charged on late payments and the rate usually ranges from 1 to 2.

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

Working Overtime In Malaysia Here S What You Should Know By Legal Street Medium

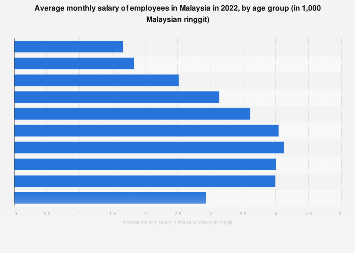

Malaysia Average Salary By Age Statista

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

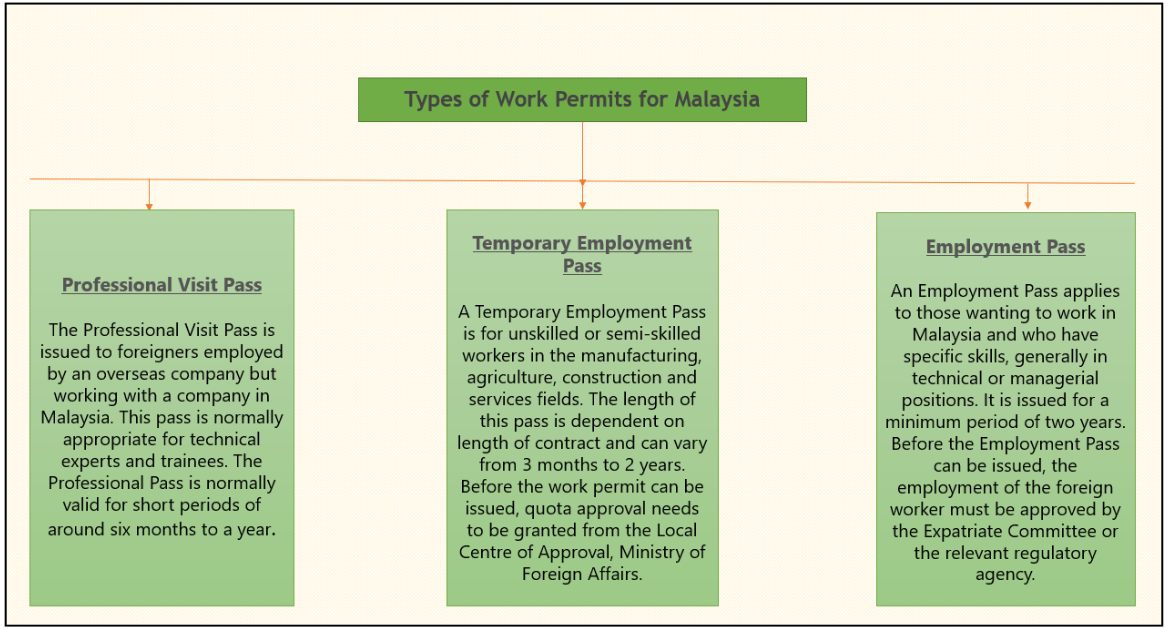

Everything You Need To Know About Running Payroll In Malaysia

Get Our Sample Of Dividend Payment Voucher Template For Free Dividend Value Investing Payment

Uae Financial Market Gold Slips On Higher Dollar As Prospect Of Dec Us Goldrateusa Gold Rate Gold Financial Markets

Everything You Need To Know About Running Payroll In Malaysia

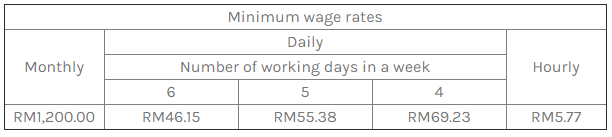

Employment Law New Minimum Wage Rates To Take Effect On 1 February 2020 Lexology

Individual Income Tax In Malaysia For Expatriates

Speaking About The Problems Of Water Quality In Malaysia Water Quality Water Drinking Water

Malaysia S Focus On When To Raise Minimum Wage Must Not Forget Why Fulcrum

Everything You Need To Know About Running Payroll In Malaysia

Leave Application Form Word Template Application Form Templates Printable Free

What You Need To Know About Payroll In Malaysia

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

No 19 Archicentre Facade Design Facade Architecture Architecture